01 January 2025, Mumbai

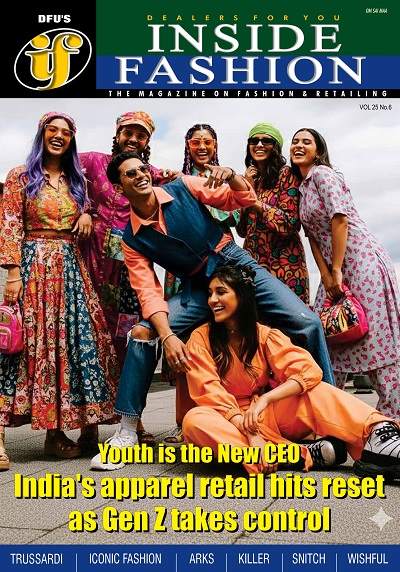

As 2025 draws to a close, the Indian fashion industry is standing at its most significant crossroads in a decade.

For the past five years, the narrative was singular: the meteoric, almost gravity-defying rise of "Ultra-Fast Fashion."

Publications Portfolio

Driven by a Gen-Z thirst for micro-trends and the algorithmic precision of digital-first disruptors, the fast-fashion segment in India grew at a staggering CAGR of 24% between 2021 and 2025. This growth far outstripped the 8% growth of traditional legacy players during the same period. Brands like Zudio, Snitch, and various international labels utilized high-velocity drops to turn inventory into a form of social currency.

Sustainability

However, as we look toward 2026, the velocity trap; a cycle of eroding margins, unsustainable returns, and trend-fatigue, is causing a strategic pivot.

The coming year marks the Great Recalibration, where established brands and companies like ABFRL, AFL, Raymond, and Trent are no longer just defending their territory; they are weaponizing their institutional scale to reclaim the high street and the wardrobe.

Visit for more

Why fast fashion ran away with the market

The rapid ascendancy of fast fashion was no accident. It was built on the "AAA Formula" of accessibility, affordability, and attractive trends.

While legacy brands were tethered to traditional six-month design calendars, fast-fashion players were operating on 15-day cycles. T

his allowed them to capture "thumb-stop" moments on social media and convert them into sales within hours.

Fashion Guru

By the end of 2025, the fast-fashion market in India reached an estimated valuation of $15 billion, fueled largely by the aspirational youth in Tier-II and Tier-III cities who demanded global runway looks at local price points.

Established brands initially struggled with this trend lag, finding their premium-priced, durable essentials ignored in favor of ₹999 disposable chic.

The historical context of the last four years shows a massive gap in inventory turnover, where fast-fashion disruptors achieved ratios of 10x to 12x, compared to the 3x or 4x typical of legacy brands and retailers.

DFU Profile

Historical growth benchmarks: 2021–2025

|

Metric

|

Fast-Fashion Disruptors

|

Legacy/Established Brands

|

|

Annual Revenue Growth (Avg)

|

22% - 28%

|

7% - 10%

|

|

Inventory Turnover Ratio

|

8x - 12x

|

3x - 5x

|

|

Customer Acquisition Cost (CAC)

|

₹1,200 - ₹1,800

|

₹400 - ₹600

|

|

Design-to-Shelf Cycle

|

15 - 21 Days

|

4 - 6 Months

|

The digital ceiling and the return to physical moats

The tide is turning as we enter 2026 because the very digital-first nature that allowed disruptors to scale has become their greatest liability.

By late 2025, digital marketing costs in India surged to a point where Customer Acquisition Costs (CAC) began swallowing nearly 45% of the average order value for fast-fashion brands.

Join our group

Simultaneously, the industry-standard 30% online return rate for trend-led items created a "leaky bucket" that venture capital could no longer plug.

In contrast, established brands have spent 2025 leveraging their institutional balance sheets to lock down prime real estate in emerging hubs like Ludhiana and Coimbatore, effectively pricing out smaller, cash-strapped disruptors.

The "Physical Wall" is now a strategic advantage, providing a touch-and-feel experience that reduces returns to less than 10% when items are fitted in-store.

Join our community

The 2026 Shift: Strategic transformation points

|

Strategic Pillar

|

The Fast-Fashion Model (2025)

|

The Legacy Counter-Strike (2026)

|

|

Supply Chain

|

Third-party / White-label

|

Full Vertical Integration

|

|

Real Estate

|

High-street "Hype" stores

|

"Lease Lock" in Tier-II/III Hubs

|

|

Product Cycle

|

52 Weekly Micro-Drops

|

12 Monthly Strategic Capsules

|

|

Logistics

|

Pure E-commerce/Q-commerce

|

Omnichannel (Ship-from-Store)

|

|

Core Metric

|

GMV & Top-line Growth

|

LTV & EBITDA Margin

|

Weaponizing the loom through vertical integration

The 2026 outlook for C-Suite leaders in the established sector is defined by a return to vertical mastery. Legacy giants are no longer trying to beat fast fashion at the "cheap" game; they are winning at the "value" game.

A primary case study is the Tata Group’s dual-brand strategy. While Zudio successfully captured the value-fast-fashion segment, the group’s legacy brand, Westside, saw a massive 39% revenue surge in late 2025 by adopting Monthly Capsules.

Visit for more

By refreshing 15% of their floor stock every 30 days, they matched the visual freshness of fast fashion while maintaining the quality and fabric integrity that legacy brands are known for.

Furthermore, established players are weaponizing their supply chain sovereignty.

While fast-fashion brands often struggle with quality variance due to fragmented third-party sourcing, giants like Raymond and Arvind Fashions own the entire value chain; from the fabric loom to the retail rack.

Must refer

By 2026, these players are expected to see their EBITDA margins stabilize between 18% and 22%, whereas pure-play fast fashion entities are projected to languish in the 5% to 8% range due to rising logistics and RTO (Return to Origin) costs.

This return to quality is a growing consumer sentiment; a 2025 industry survey revealed that 64% of shoppers now prefer "durable trends" over "one-wear garments" as the novelty of disposable fashion wears off.

Event

Transforming stores into profit-generating assets

Established brands are also redefining the store's role for the 2026 landscape. Physical outlets are transforming into Experience Hubs and Micro-Fulfillment Centers.

By using stores as "Dark Stores" for quick-commerce partners, legacy brands are capturing the utility buyer who needs a basic shirt or socks in 10 minutes, and then using that data to drive high-margin, occasion-wear purchases in-store.

Sustainability forum

This human-led approach involves training retail associates to act as style influencers for local WhatsApp communities, creating a deep-rooted loyalty that a faceless algorithm cannot manufacture.

The profitability gap is becoming stark. While fast-fashion brands struggle with a 55% gross margin that is quickly eroded by marketing, established vertical brands are hitting 70% gross margins by removing the middleman at every stage of production.

Trade report

Unit economic comparison (2026 Projection)

|

Financial Metric

|

Pure-Play Fast Fashion

|

Established Omnichannel Brand

|

|

Average Order Value (AOV)

|

₹1,200 - ₹1,800

|

₹3,500 - ₹5,500

|

|

Gross Margin

|

52% - 58%

|

66% - 74%

|

|

Marketing Spend

|

25% of Revenue

|

8% - 12% of Revenue

|

|

Logistics & Returns

|

16% of Revenue

|

5% of Revenue

|

|

Net Profit Margin

|

4% - 6%

|

14% - 18%

|

|

Store Productivity

|

High Traffic/Low Conversion

|

Moderate Traffic/High Basket Value

|

Editor’s Conclusion: The dawn of resilient retail

The narrative of "Legacy vs. Fast Fashion" is maturing into a story of "Resilience vs. Burn." The year 2026 will not belong to the fastest brand, but to the most efficient one.

The lost ground of the early 2020s is being reclaimed by established titans who have finally learned to dance at the speed of the internet while standing on a foundation of institutional scale.

Wrapup 2025

These winners are synthesizing the two worlds: adopting the digital agility of the disruptors while using the physical store as a high-margin fortress.

As we look ahead, the Great Recalibration proves that in the volatile world of Indian fashion, while trends are fast, trust and infrastructure are the only things that truly endure.

The era of buying growth with venture capital is ending; the era of earning it through operational excellence has returned.

LATEST FASHION NEWS