13 December 2025, Mumbai

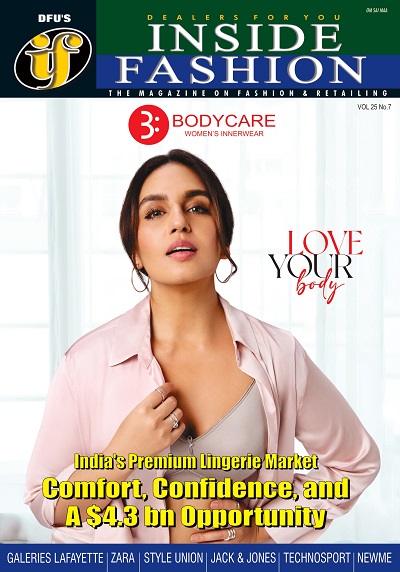

India’s intimate wear market is rapidly shedding its purely functional image and evolving into a lifestyle-led, premium fashion category.

Know More

According to a recent IMARC Group report, the India Premium Lingerie Market is projected to grow from USD 1.9 Billion in 2025 to a substantial USD 4.3 Billion by 2034, clocking a strong CAGR of nearly 9.50% between 2026 and 2034.

This robust growth signals a fundamental shift in consumer perception. Lingerie is no longer viewed as a hidden necessity but as an extension of personal style, comfort, and self-confidence.

Young, urban, and financially independent women are increasingly prioritising fit, fabric quality, and design, accelerating the transition from mass-market basics to premium, fashion-forward offerings.

What Is powering the growth

Rising disposable incomes and an improving quality consciousness are central to this transformation. As purchasing power expands, consumers are upgrading to branded, better-designed, and superior-fabric products.

Simultaneously, growing exposure to global fashion trends through social media, along with the entry of international players such as Triumph and Wacoal and well-funded Indian D2C brands, has raised expectations around aesthetics, innovation, and inclusivity.

Publications portfolio

Another major catalyst is the rapid expansion of e-commerce and organised retail. Online platforms have helped overcome long-standing discomfort associated with buying intimate wear in physical stores by offering privacy, wider size ranges, and technology-led fit solutions.

This has dovetailed with a strong consumer shift towards comfort-led products, including non-wired bras, seamless lingerie, bralettes, and sports bras, reflecting evolving lifestyles and wellness priorities.

The rising demand for functional and performance-oriented innerwear also contributes to the premium segment's growth, driven by an increase in active lifestyles.

Fashion Guru

Market snapshot and structure

The IMARC study provides a concise breakdown of the market structure and key projections:

|

Indicator

|

Details

|

|

Market Size (2025)

|

USD 1.9 Billion

|

|

Projected Market Size (2034)

|

USD 4.3 Billion

|

|

CAGR (2026–2034)

|

Nearly 9.50%

|

|

Dominant Categories

|

Bras, Knickers & Panties

|

|

Emerging Categories

|

Shapewear, Bodysuits, Comfort & Performance Wear

|

|

Key Channels

|

Strong shift from Offline to Online

|

|

Regional Trends

|

North & West lead; South & East gaining momentum

|

Bras and panties continue to account for the largest share of premium lingerie sales, aligning with their status as daily essentials. However, newer segments like shapewear, bodysuits, and performance-driven athleisure categories are witnessing faster growth as consumers experiment with newer silhouettes and multi-functional wear.

Regionally, North and West India remain early adopters due to higher fashion awareness and spending power, while South and East India are rapidly emerging as high-growth markets supported by urbanization and deeper digital penetration.

DFU Profile

New Rules of Competition: Inclusivity and sustainability

Competition in the premium segment is no longer driven by price alone; it is defined by values. Size Inclusivity has become a decisive differentiator, with brands expanding cup sizes, fits, and silhouettes—often reaching up to 6XL in some categories—in line with the global body-positivity movement. Homegrown D2C brands like Clovia, which recently launched a collection of plus-size bras, are actively responding to this demand, focusing on features like wide wings and full-coverage cups to ensure comfort and support for fuller busts.

Join our group

Concurrently, Sustainability is also gaining prominence. Environmentally conscious consumers are increasingly seeking lingerie made from organic cotton, bamboo fibres, Modal, Tencel, and recycled materials. Brands like Inner Sense are pioneering this space with products specifically designed from a unique blend of bamboo fibre and organic cotton, emphasizing anti-microbial and moisture-wicking qualities suited for the Indian climate.

Personalisation, enabled largely through D2C models, is further reshaping the category. Virtual try-ons, AI-based fit recommendations, and customised shopping journeys are helping brands deepen engagement with premium consumers and improve repeat purchases.

Join our community

Zivame and the digital disruption

The modern premium lingerie market in India was catalysed by digital-first pioneers such as Zivame, which challenged deep-rooted taboos around intimate wear shopping.

By focusing on privacy (via discreet packaging), education (through detailed size guides and calculators), and fit accuracy (via professional fitting services), the brand transformed lingerie buying into a confident, informed experience. This approach addressed key consumer pain points and helped normalise premium lingerie consumption.

This model was subsequently mirrored by D2C counterparts like Enamor and Clovia, which reinforced the narrative of confidence and self-expression through campaigns celebrating the modern Indian woman, collectively accelerating the shift towards premiumisation across the category.

Visit for more

The category at an inflection point

With rising affluence, increasing fashion awareness, and the rapid normalisation of online buying, the Indian premium lingerie market is entering a decisive growth phase.

Backed by the twin pillars of Inclusivity and Sustainability, and leveraging technology-led retail models, the segment is set to emerge as one of the fastest-growing categories within India’s apparel and fashion ecosystem over the next decade.

The market’s future is not just about growth in size, but about growth in consciousness and empowerment for the Indian consumer.

LATEST FASHION NEWS

_thumbnail.jpg)